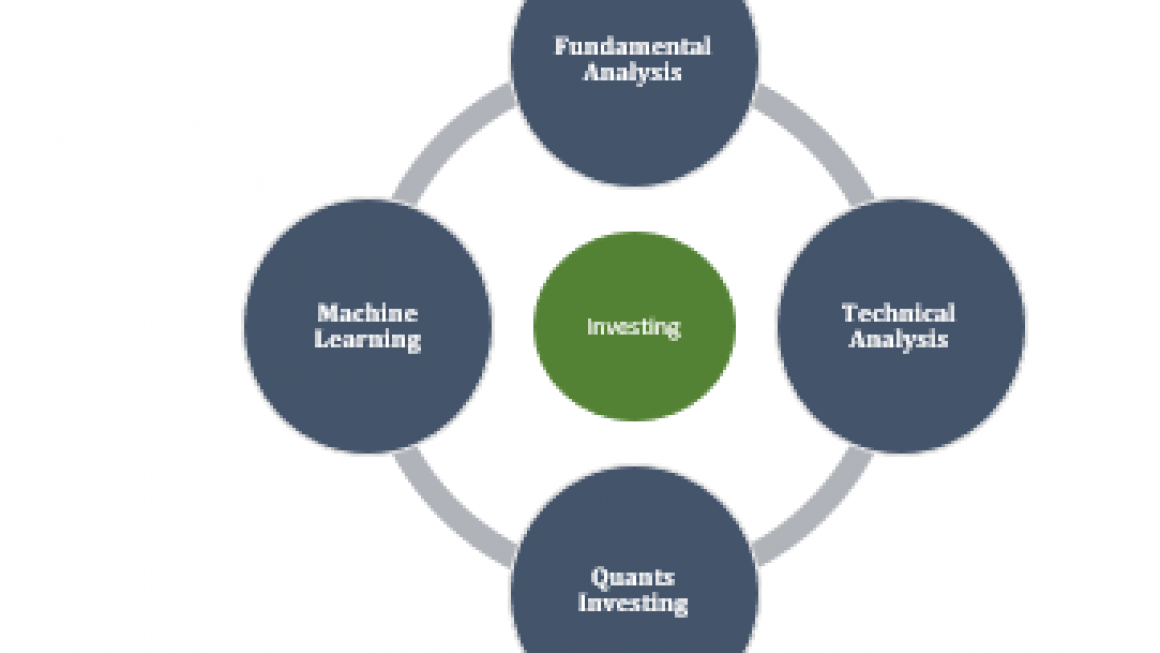

Fundamental analysis (FA) is the examination of the related financial and economic factors. This method evaluates the fundamental value of an asset in the future. This analysis is mainly based on external influences and events. Fundamental analysis is also part of the two main methods of analyzing the market, the other one is technical analysis. As for technical analysis, it is capable of deriving all the necessary information needed to trade while fundamental analysis focuses on the outside factors of the asset’s price movement itself.

What Are The Examples of Fundamental Analysis

The Fundamental Analysis can be utilized with different techniques and tools. It is further categorized into two different types, the bottom-up analysis, and the top-down analysis.

Top-down analysis is the wider view of the economy. It starts from the entire market then narrows down into different sectors, industries, and into the specific company. As for the bottom-up analysis, it starts with a certain stock then develops into different factors that affect the price. Most of the time, fundamental analysis is utilized for the evaluation of share prices. However, it can also be used over different classes of assets including Forex trading and bonds.

Traders have the freedom to choose the tools that they want to use for the fundamental analysis that they have. It all depends on the assets which are being traded. Share traders, for instance, use figures in determining the earnings of the company. This includes revenue, profit margin, earning per share (EPS), and the projected growth.

As for Forex Trading, they may assess figures depending on the central banks which gives them insights on the economic state of a country.

Advantages of Fundamental Analysis

There are a couple of advantages that fundamental analysis has to offer. It helps traders in gathering the right information which could result in a rational decision in the right position to take in. The main bases of their decisions are financial data, therefore, it offers limited room for personal biases.

Traders and investors using fundamental analysis understand the asset’s value for a broader view of the financial market. Until such time that the trader will be able to establish a numerical value, they will be able to compare it to the actual market price and assess whether it is undervalued or overvalued. This fundamental analysis aims to gain profit coming from a market correction.

Disadvantages of Fundamental Analysis

If there are a set of advantages, there are also disadvantages that need the right understanding. Though very effective, fundamental analysis can be very time-consuming. A trader who utilizes fundamental analysis needs to see through different areas of analysis, making the process very complicated.

Additionally, fundamental analysis requires a longer-term market view and the results of each finding won’t be suitable for swift decisions. It is important to note that there are worst and best-case scenarios in fundamental analysis. Though it provides a well-rounded view of the market, there are drastic changes that will surprise you, including negative economic outcomes, legislative changes, and political changes.