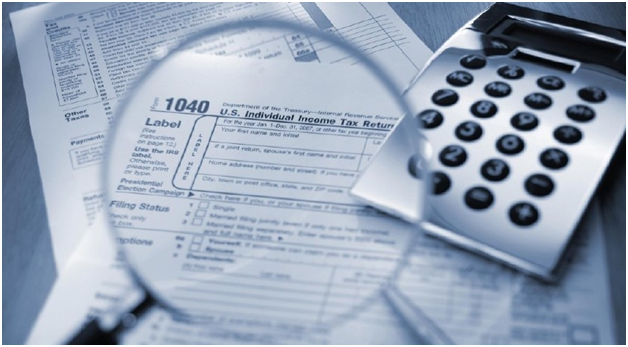

American tax preparation process can vary from extremely easy to extremely difficult approach. Taxpayers who are still compiling tax records and getting confused as of where to start from, hiring American taxation service might be the best option. The more difficult the taxation forms looks, the more sense it makes to hire a professional tax preparer to prepare the tax laws dedicatedly on your behalf with accuracy.

Everyone (who earns cash or hold assets) needs to file their eligible taxes each year and this is the point when many taxpayers have issues with the whole tax filing procedure. This is why professional USA taxation service in Singapore has become so popular, as they offer taxpayers exactly the support (valuable services) they need to deal with the preparation of tax season.

However, if you are still weighing the costs of hiring the tax preparation services of a professional tax preparer versus doing the taxes yourself, you may need to consider the detailed of tax preparer services and how they will assist you during the tax season.

Tax Preparation Services offered by a Professional Taxpayer

IRS Representation

A piece of paper or document (letter) notifying that your tax return has been selected for the IRS audit may horrify you. And this situation is normal but you don’t need to panic at all. In such a critical situation, you should need to have the assistance of US tax preparer in Singapore and his valuable services, for several reasons. Experienced tax preparer knows how to deal with the situation professionally and with proper records. Unparalleled knowledge of tax laws and the procedure is the great advantage of experienced tax preparers as they negotiate with the IRS on your behalf without you having to interact with their representatives.

An experienced tax preparer will help you reduce the financial and mental stress that dealing with the IRS causes.

Payroll Services

When it comes to paying the employees, tax laws especially IRS have made the payroll process a time-consuming nightmare for small business owners. According to a survey report, it has been noticed that business owners spend an average of eight hours a month for computing the payroll of employees. That’s 12 full days of a year that could be spent potentially in maximizing the business revenue or generating sales opportunities. Instead of devoting productive time in a task that you are not specialized at, outsource your payroll duties to a dedicated tax preparer who enables you to spend time doing what you can do best- operating the business.

Sales Tax Service

Filing an accurate sales tax return requires tax expertise. You need to make sure that you do not pay more taxes than required. It’s also important that you file and pay on time to avoid future penalties and interests. Considering the challenges involved in filing sales return, incorporating the excellence of sales tax preparer is the best option who will timely review your transactions and determine your liability as well as accurately prepare the sales tax return.

Credible US tax advisor Singapore has years of knowledge and know-how to eliminate any potential tax problems. They have gained invaluable experience to find deductions that you might overlook but they won’t. Hiring the USA tax preparation service of an experienced tax pro is a safe way to avoid legal consequences.